If you’ve been dreaming of selling your business and riding off into the sunset with a big lump sum, you might be surprised when the buyer says, “Not so fast.” While every seller hopes for an all-cash deal at closing, buyers often use a variety of tools—like escrows or earnouts—to spread out the payout and limit their own risk. Below, we’ll walk through several common structures so you’ll know what to watch for before you ink any M&A agreement.

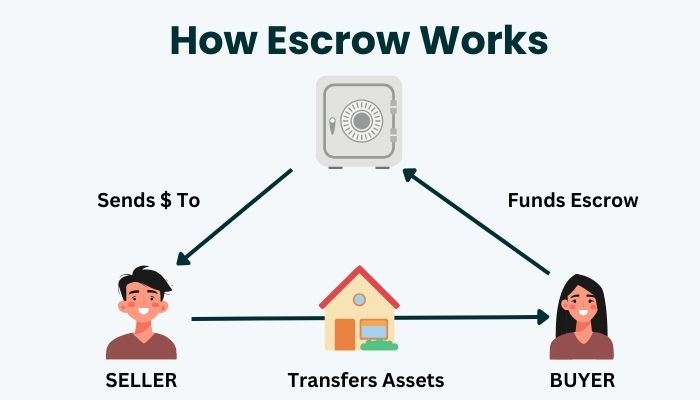

Escrows: Where Part of Your Money Waits on the Sidelines

When setting up a transaction, buyers frequently request that a portion of the purchase price be placed into an escrow account. Think of it like setting aside a “just in case” fund that’s released to you over time, assuming your business hasn’t misrepresented any facts or neglected any key liabilities.

- Why Buyers Like It: An escrow protects them if something goes wrong after closing—like undisclosed debts or legal troubles.

- Why It Matters to You: Even though this money is technically still yours, you won’t see it until after the escrow period ends, and only if no claims arise against it. Be sure to confirm the terms under which escrow funds are released.

Earnouts: Putting Your Future Payout on Future Performance

Earnouts tie part of your compensation to how well the business performs once it’s in the buyer’s hands. Targets can include revenue milestones, profit margins, or customer-retention goals. If these targets are met (or exceeded), you’ll get your extra payout; if not, that money might never materialize.

- Why Buyers Like It: Earnouts incentivize the former owner (you) to maintain or even boost the company’s results, helping ensure they’re not overpaying.

- Why It Matters to You: If you lose control or oversight of critical decisions once you’ve sold, hitting those targets might be more challenging than you expect.

Seller Financing: When You Act Like the Bank

If a buyer doesn’t want to put all their cash upfront—or can’t secure enough from lenders—they may ask you to finance part of the sale via a seller note. You’ll get some cash now and collect the rest, with interest, over time.

- Why Buyers Like It: It reduces their initial capital outlay and can help them close a deal they might otherwise struggle to finance.

- Why It Matters to You: While you may earn interest, you’re accepting the risk that the buyer could face financial trouble and default. Make sure you vet their financial stability and hammer out strong repayment terms.

Stock Considerations: Trading Cash for Equity

Sometimes, a buyer will offer you stock in the acquiring company instead of paying everything in cash. This can significantly change the dynamics of your potential earnings.

- Why Buyers Like It: They can conserve cash while also aligning your interests in the company’s future success.

- Why It Matters to You: Holding stock can be great if the combined entity thrives—your potential upside may be huge. But if the stock value falls, or if the company’s performance lags, you might end up wishing you had secured more cash at closing.

Holdbacks: Another Way to Delay Payment

A holdback is similar to an escrow but more informal: the buyer simply withholds a portion of the purchase price until certain conditions are met. For instance, if you promised that a large client would renew, the buyer may keep back some of your payout until after that renewal is locked in.

- Why Buyers Like It: They don’t need a separate escrow account and have direct control of the withheld funds if something goes awry.

- Why It Matters to You: Anytime a buyer hangs onto your money, there’s a risk they could dig up reasons to keep it. Spell out exactly what must happen for you to receive your full payment.

Conclusion

It’s easy to focus only on a fancy “headline price,” but how and when that price reaches your hands is just as important. Escrows, earnouts, seller financing, stock considerations, and holdbacks can all chip away at your immediate payout—or potentially boost your total if things go well.

Talk to a reputable M&A advisor or attorney who can help you navigate these structures and negotiate the best possible deal. By understanding these tactics upfront, you’ll be better prepared to protect your interests—and maybe still ride off into the sunset, eventually.