Mergers and acquisitions (M&A) are complex investment decisions that involve considerable capital, strategic positioning, and industry-specific knowledge.

In particular, a sell-side M&A event is when the seller divests into another investor for financial purposes. Understanding different types of auctions that can be used during this process is critical for achieving maximum value from a potential purchaser or buyer in the transaction.

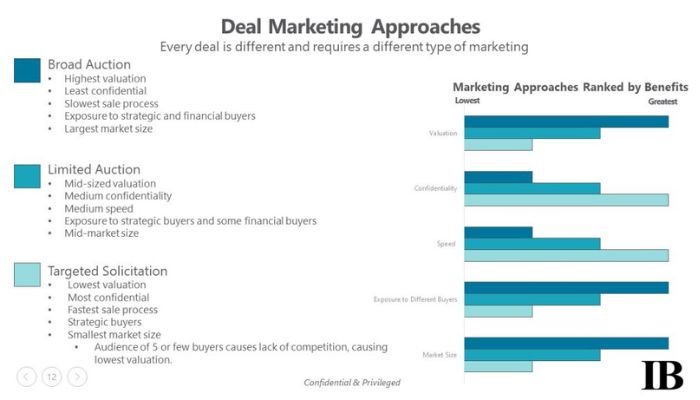

This paper will explore the various approaches when running an auction to secure the best possible terms of agreement for both parties involved in a M&A transaction, specifically focusing on targeted solicitation, limited auctions, and broad auctions as key processes discussed throughout.

Furthermore, factors influencing selection along with key aspects of each approach and scenarios where one approach may suit better than others where also be discussed.

1. Targeted Solicitation

Targeted Solicitation is a common approach used for sell-side M&A. In this type of auction, bids are typically solicited only from select strategic suitors who have identified the target company as particularly attractive or commonly show high interest in its acquisition prospects.

Targeted solicitations allow sellers to focus on reaching out specifically to chosen buyers who fit pre-defined characteristics seeking creditable bidders whose offers generate maximum value and terms favored by the seller.

Additionally, it provides an open channel for constructive negotiation by connecting proactively with interested strategic buyers, allowing them to form reciprocal agreements before going live on broader auctions.

Most importantly targeted solicitation Auctions usually result in lucrative sales prices – if properly appraised – compelling both acquirers and investors alike into convincing win-win resolutions optimized for all stakeholders.

Key Characteristics and Benefits

Targeted Solicitation is the most selective auction approach, and as such has some key characteristics and benefits for sellers looking to acquire a buyer. Specifically, the seller strikes deals with specific buyers already selected through extensive research activities.

This enables the seller to negotiate higher value returns due to its ability to maintain confidentiality, limit market disruption caused by information publicity, eliminate costly auctions process timelines involving large numbers of bidders and allow even disadvantaged buyers an opportunity in obtaining desired targets.

Overall, Targeted Solicitation provides enhanced pricing premiums over traditional auction processes while maintaining enough security around negotiations– making this strategy often times more preferable from a variety of perspectives.

When to Consider Targeted Solicitation

Targeted solicitation is well-suited for sellers who are focused on maximizing the transaction value, especially when market conditions and fit with potential acquirers would be favorable to an uncontested process.

Companies should consider targeted solicitation when they want more control over the timeline and process dynamics than a broad auction provides; when multiple bidders increase complexity; or want to reduce the risk of information leaks or ensure that strategic objectives are kept confidential.

The primary limitation associated with this approach, however, is foreclosing potentially higher offer prices via a broader bidding pool in a true auction into a shared exclusive negotiation session.

Potential Drawbacks or Limitations

Targeted Solicitation is very limited because of the nature of its design. Without a wider bidding audience, deal costs may be higher due to fewer selections with potentially more competition for that specific party.

Additionally, if it fails to attract attention or interest from bidders, then targeted solicitations lack flexibility and opportunity which leads to challenges in maintaining competitiveness and setting realistic pricing expectations initially.

Furthermore, risks such as imbalanced bargaining powers become prevalent when there are limited solicitors involved so buyers can leverage their negotiating power over the selected parties easily due to the diminished choice and options.

2. Limited Auction

A limited auction is a moderated bidding process for M&As that involves only submitting sealed, binding bids after potential buyers have been identified and invited to pursue an acquisition target. During the auction, there may also be a negotiation period before the final bidder is selected.

A key characteristic of this approach is that its scale and intensity may be tailored to meet the unique needs of each situation while limiting exposure in terms of confidential information or marketing efforts.

By conducting a limited number of contacts with predetermined participants may be assessed within a significantly shorter time frame enabling more concise valuation thoughts and faster results as compared to other approaches.

Key Characteristics and Benefits

A Limited Auction involves selectively engaging with a small group of chosen bidders, anonymous or otherwise.

Some variables to consider when determining which approach should be employed are the size and complexity of the deal, the number of interested parties, time-sensitivity to execute transactions expeditiously, etc.

Benefits include greater control over information sharing throughout negotiations and potential better outcomes in terms of price and transaction certainty. However working too closely with buyers could leave little room for additional possible offers.

When to Consider Limited Auction

Limited auctions are an ideal choice when there’s limited buyer interest and it’s important to maintain discretion and confidentiality about the sale or transaction. This approach is often seen in smaller, privately-held companies where owners prefer a single offer from one platform partner or strategic buyer.

Limited Auctions limit competition and advantages certain buyers at the expense of increasing bidding anxiety and reduced transparency for related parties. If price is less critical than possibility speed to evaluate offers more accurately then this strategy may have its benefits since it involves excluding some buyers from participating in the auction process altogether.

Potential Drawbacks or Limitations

Limited Auctions have the potential drawback of bidding parties being limited in their ability to expression values and ability to capture favorable terms for value maximization; this is due to the often-shorter timeframe the auction process provides.

There are cases where good targets may be overlooked by some buyers, typically due to a narrow viewfinder given that a specialist auctioneer will take care of this process.

In addition, information asymmetries might still prevail adopting this approach, creating uncertainty among bidders on what was expected throughout the process by their competitors.

3. Broad Auction

Broad Auctions are a type of competitive bidding process that solicits bids from many prospective buyers simultaneously. Unlike Limited Auctions, Broad Auctions tend to involve a large number of bidders competing against one another.

This increases the auction’s chance of success in terms of getting maximum value for the seller and creates an environment conducive to substantial price improvement as multiple packs essentially bid each other up during negotiations without constant back-and-forth negotiations with management or intense price gouging (like upwards reauctioning) techniques encouraged by high levels emotional and financial tension confronting bidders.

Key Characteristics and Benefits

Broad auctions involve soliciting multiple potential buyers using public means such as advertisement campaigns in print and through third-party sources.

Benefits of a broad auction include allowing any qualified buyer to participate, creating competition among bidders due to the presence of multiple offers, reducing transaction costs, improving antitrust clearance chances by wide offer dissemination etc.

Its key characteristics are a short sales process timeframe compared with its alternatives as well complex disclosure demands along with difficult negotiating, and extensive legal documentation involved which may attract extra charges with parties other than seller and buyers.

Potential Drawbacks or Limitations

Broad auctions are an attractive option for a wide range of stakeholders. Companies benefit from increased competition, heightened price valuations, and greater transparency. Investor groups appreciate the bidding environment leveraged by strong regulatory protection.

With this substantial upside to consider, broad auctions become viability when there is ample time (6-8 weeks) or exposure to attract more buyers and result in premium sales prices reached through competitive bidding.

However, with that being said there are potential downsides which include more unpredictable results due to factors such as high bidder withdrawal rates, buyers’ hesitancy to bid outside their standard acquisition parameters, among others.

Factors Influencing Auction Choice

Company Size and Market Presence

Company size and market presence are important factors to consider when deciding on an auction approach with a Sell-Side Merger & Acquisition. For larger, established companies, a Broad Auction may be most beneficial as it will allow access to the widest pool of potential buyers.

Conversely, smaller or newer companies might be better off with a Targeted Solicitation Auction that limits invitations only to select bidders who can make reliable offers.

Similarly, if the company has strong ties in its industry or high visibility in its market, executives should opt for either Limited or Broad Auctions so they maximize interest and foster competition from multiple buyers.

Industry and Market Conditions

Industry and market conditions play a key role in deciding what style of auction is best for Sell-Side Mergers & Acquisitions.

Markets that are defined by oligopoly are naturally suited to a targeted solicitation approach, while broader markets pair better with limited and broad auction turns respectively as these approaches introduce additional complexity to the situation.

Seasonality can also have an influence on selection—a seller vying for winter divestitures will want to move quickly, influencing which strategy should be chosen upon first evaluation. Knowledge of when markets tend to flourish or stall due to external factors can add refined accuracy and detail behind pricing expectations as well.

Timing and Urgency

Timing and Urgency are important factors during the auction process. If the seller has limited timing available or large amounts of debt to repay, they may opt for a speedy, Limited Auction. This type of auction allows them to close on a deal quicker than other types but at the expense of potentially leaving money on the table.

On the other hand, if timing is less an issue and demand for a target increases due to higher quality buyers entering into the market then broad competition could lead to offers that exceed initial expectations offered in Limited Auctions.

As such, it’s important that Sell-Side M&A participants consider their timelines when selecting between different Auction Approaches.

Competitive Landscape

The competitive landscape is an important factor to consider when selecting the correct auction approach for sell-side M&A. If there are few potential buyers in the market, then a targeted solicitation or limited auction could be preferred as they generally generate fewer bids and allows sellers more control.

Alternatively, if there exists a wide field of interested buyers, then a broad auction may be better suited since it preserves bargaining power and allows bidders to interact with each other in order to increase atmosphere competition.

Ultimately, researching competitors thoroughly can help identify which option abides by best practices while concurrently maximizing value during negotiations.

Conclusion

The three main auction approaches for sell-side M&A transactions are Targeted Solicitation, Limited Auction and Broad Auction. Each auction type has its own distinct characteristics that should be taken into account when considering which approach is going to maximize value.

Ultimately, the selection of the right auction depends heavily on aspects like company size and market presence, industry conditions, timing importance, and competitive landscape. All these individual aspects should be considered together to ensure that you making decisions in an optimal way when selecting a seller-side M&A transaction approach.