*The content of this article is based on our past collective experience and academic research we have undertaken on this topic.

No two buyers or investors are created equal. Differences in capital structure, management methodology and market expertise can all play a key role in process, timing and closing of deal.

Here we’ll discuss some of the nuances between financial and strategic buyers and how the subtle differences between the two can mean big differences when it comes time to get a deal done.

The Strategic Buyer

Strategic buyers seek to purchase a company in their industry that has a process, know-how, patent(s), workforce, or other appealing asset(s) that can help the buyer’s business prosper. This could result from the acquisition of new technology or the expansion of a product or service line. You can review our quick guides on vertical acquisitions and horizontal acquisitions to get a better understanding of how and why a buyer may pursue a specific acquisition strategy.

As a strategic buyer you should be aware of the ability to eliminate redundancies that arise post-transaction. These redundancies are generally found in accounting or HR, but can be identified throughout the organization. While this shouldn’t form the base of the business case for the acquisition it is certainly an area that should be explored.

A seller will more often than not view the strategic buyer, as opposed to the financial buyer, as the party willing to pay a premium for the business. This can be for a few reasons.

First, the strategic buyer is interested in a buy and hold strategy and has identified synergies between the existing business and target company. The better the “fit” between the buyer and seller the greater premium a buyer is generally willing to pay. A financial buyer is more of the mind to “buy low and sell high”. They want to purchase a business, drive efficiencies and scale the entity, and eventually exit. The financial buyer generally won’t be too concerned with synergies unless the acquisition is an add-on for an existing portfolio company.

Second, a large strategic buyer may have access to larger funds. A larger strategic buyer also has the benefit of being able to issue stock as part of the consideration in a transaction. This ability to offer various forms of payment for the business gives the strategic acquirer an ability to be flexible when discussing deal structure that a financial buyer does not have. A financial buyer is normally limited to the funds raised from investors. In addition to funding limitations the financial buyer is also concerned with generating an acceptable return for investors. This focus on returns means that they must be very careful to not overpay for a company.

A third consideration is that financial buyers tend to use debt to finance an acquisition. The use of debt forces them to ensure the target company has sufficient assets, such as property, plant & equipment (PP&E), to service the debt. This is again motivation for the financial buyer to ensure they are not overpaying and taking on more debt than they can handle.

The Financial Buyer

The financial buyer is not one specific type of buyer. Rather, the category encompasses a wide variety of mostly institutional buyers. Some of the most common include:

- Venture Capital (VC) firms

- Private Equity (PE) firms

- Family Offices

- Holding Companies

While each of the above groups are different both in structure and how they operate, they share a commonality in the type of seller they attract. Whereas the strategic buyer is looking to purchase a company and take over operations, the financial buyer is more comfortable with a partial ownership stake or acting as a short to mid-term financial sponsor. For this reason the financial buyer is more likely to attract sellers who are seeking only a partial exit or who want to exit the business from an ownership perspective, but remain on in some capacity following the transaction.

The buyer’s approach with existing personnel may be a key consideration for some sellers. Business owners who are concerned about the future of their employees may be hesitant to work with a strategic buyer. This is especially true in businesses where the existing owner is also the founder and many on the staff have been with the company for an extended period of time. As previously mentioned, a strategic buyer may be able to generate some early synergies by removing redundancies. A financial buyer, however, is likely to leave most, if not all, of the personnel in place. They may take an advisory role and leave the day-to-day operations to the current team.

Financial buyers tend to vary in their investment time horizon. Where a PE firm might want to make an investment and exit in 5-7 years a family office may have an indefinite holding period. This is of course a consideration for each firm and no one approach is superior to another. How your firm is structured and the ultimate investment mandate will make clear holding requirements. A strategic buyer, on the other hand, is generally interested in purchasing a company, integrating it into the existing business, and holding for the long term.

A third category of buyer that we have yet to mention is the operational buyer. This type of buyer is interested in purchasing a business where they will be directly involved in the day-to-day operations. These buyers generally focus on smaller companies and may even be from within the target company.

Some examples of operational buyers include:

- Search Funds

- Employee Stock Option Plans (ESOPs)

- Management Buyout (MBO)

While the various buyer groups described above will impact how you are perceived by the seller, the M&A process remains the same. A letter of intent (“LOI”) is signed, due diligence is conducted, and a purchase agreement is executed. The primary difference in the deal process will be seen during negotiations. Strategic and financial buyers will have different considerations. As such, they will approach negotiations in a different manner and will be more or less receptive to different deal structures based on their position.

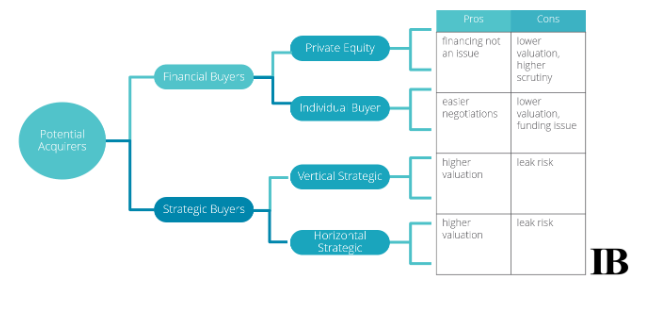

The below graphic nicely sums up what we have discussed regarding strategic and financial buyers. Note that the pros and cons are from the seller’s perspective. As is the case in many business transactions, having insight as to how the person across the table is thinking can help you formulate a winning strategy.

What does each type of buyer look for?

As stated above, financial buyers are not planning on benefitting from synergies or keeping the business forever. They usually make an acquisition to add to their fund, planning to sell the company after 5 years or so in order to make a return. With this exit in mind they will have a high-growth model in place in order to realize this return. This is an important point to make note of. A financial institution is required to return a certain percentage (IRR) to their investors. If they fail to do so, then they will have trouble fundraising in the future. Moreover, they typically have less capital to commit than a behemoth conglomerate and instead use debt to close the deal, committing only 20% or so of capital. Consequently, two things that are scrutinized while evaluating the investment are 1) having hard assets (PP&E) to secure the loans and 2) having enough free cash flows in the future to service the debt used to execute the acquisition. Among other things, they also want to know if the company is positioned in a growth market – i.e., can they expect to sell the company for more than what they paid.

I would also add that it used to be that financial buyers could make a good return from a straight financial acquisition. However, due to increased competition that is no longer the case. You can expect any financial buyer to use some degree of strategic elements in their investment in order to realize the desired return.

As for strategic buyers, they want to know what synergies can be identified from the acquisition. They want to know how the seller’s assets will contribute to their business strategy. This is a big reason why strategic buyers are assumed to pay more than financial buyers. Additionally, they will usually be planning to acquire the business for an indefinite amount of time. Therefore, the future returns will be greater for them than for a financial buyer.

Strategic vs. Financial: What Type of Buyer are You?

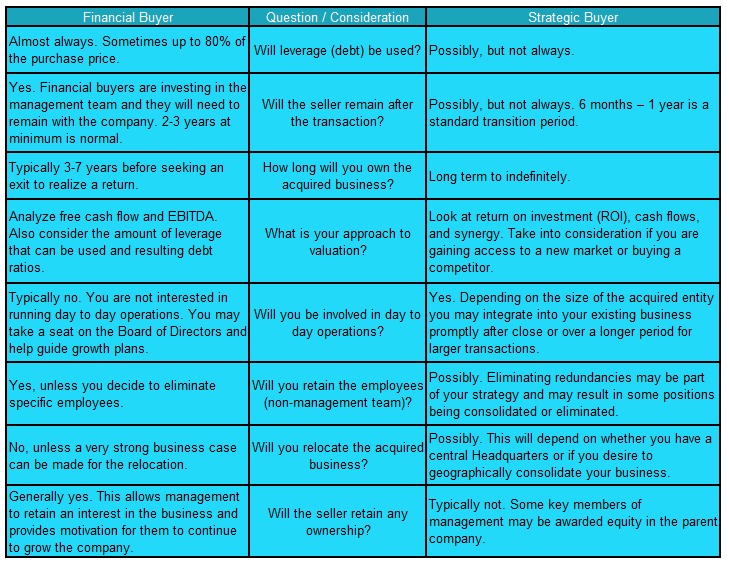

If you’ve reached this point and are still on the fence about how you are likely to be perceived as a buyer then the following Q&A should help.

Hopefully after reviewing the above you are more confident in how a seller will perceive you as a buyer. There is no right or wrong answer to the strategic vs. financial buyer question. Knowing how you will be perceived enables you to structure your approach and the deal making process in a strategic manner.

If you still have questions, or want to discuss how a Buy-Side-as-a-Service (“BSaaS”) strategy can help your firm, please get in touch. Our licensed investment bankers are ready to learn more about your business and drive value in your acquisition plans.

Deal Efficiency

This may or may not be the first time a strategic buyer will be making an acquisition. They also have a business to run and may need extra time to work with the board of directors, as well as the rest of the bureaucratic hierarchy.

On the other hand, financial buyers are essentially in the business of making acquisitions and therefore the selling process typically moves faster with them. This is attractive because it increases the probability of closing a successful deal. Although the due diligence process may take longer, once a decision is made they have a proven pattern for effectively moving through each step until closing the deal.

It is important to understand the differences between these two types of buyers in order to set the right expectations. It is of equal importance to note that financial buyers may in fact be more strategic than assumed, and that a strategic buyer with a conglomerate growth strategy can have a more financial objective than assumed.

Considering these differences, it makes sense to solicit the help of an M&A advisory firm – someone who’s in the business of selling businesses – because they will know better how to adjust the selling process to the needs and interests of the different types of buyers.