If you happen to be a business owner and also just so happen to be thinking about exiting your business in the next three years (or perhaps less) then the question “how can I maximize my selling price?” may have come up at some point in time. If so, keep reading as you have just found a rarity – a useful answer to your question!

One of the foremost things to keep in mind when hoping to maximize your timing and selling price is that there isn’t just one, but several avenues you can pursue to get multiple prospective acquirers involved in the process, which will substantially increases the odds of a fair value transaction.

Strategic Sale

A negotiated sale involves sourcing, qualifying, and selecting multiple “synergistic” acquirers – think industry or sector participants who would stand to realize substantial benefits from a combined business.

As you may have guessed a negotiated process has both its positives and at least some negatives. First the drawbacks, as with any other process but in particular this one, maximizing the sale price may prove difficult if the business in question does not possess a viable competitive advantage that is not easily replicable by a potential suitor who is also in the industry. Second, a negotiated transaction will undoubtedly involve financing, tax, and perhaps other considerations. As a direct result, the time it takes to complete a sale may lengthen and exceed the median of 9-12 months that it takes to sell a business.

On a less downcast note, while a drawn out and exhaustive due diligence process can divert management’s attention away from operations. The negotiated process itself is often less disruptive for the target and its employees on the whole, as it affords greater confidentiality and less disclosure to third parties and others such as suppliers and customers alike. All of this is paramount since the business must continue to function as it normally would throughout the sale and transition process if an optimum exit price is to be realized.

Another positive to undertaking a discreet, negotiated sale process is that by avoiding the public eye, the business also retains its future alternatives should a sale be unsuccessful for any reason or if the seller would like to re-evaluate an exit.

Broad Auction

Much like a traditional estate auction, a broad auction employs a competitive bidding process aimed at achieving the highest possible value for the seller of a business. That said, not every business lends itself well to such a sale structure.

Generally speaking, the broader the industry the business participates in (i.e. manufacturing, distribution, etc.) the larger the universe of potential buyers (obviously), but doubly so in this instance as a niche or highly specialized business where one requires specific training or education to efficiently operate will nullify the intended auction effect. On the other hand, a typical business should attract in excess of half a dozen bidders which could also include but not be limited to financial sponsors (private equity groups) and other strategic buyers who may be seeking to expand their footprint in an existing market. Finally, a growing merger and acquisition market – as has been the case for the past several years now, lends itself best to such a bidding process.

Targeted Auction

Similar to a broad auction with the primary difference being that at least some prospective acquirers will have already been pre-identified and invited to participate in the bidding process which of course can have the unintended drawback of there being less auction participants as some may elect not to take part in an open bidding process for fear of overpaying. That said, this is balanced by the fact that an auction process usually takes 6-9 months to complete and reach a signed definitive purchase agreement – a slightly shorter timespan (on average) than it takes for a strategic sale to culminate. The stages to any auction process (broad or targeted) are the same and some of these steps also prevail in a negotiated sale.

Is It Time to Sell Your Business?

Making the decision to sell a business after almost a lifetime of hard work can be a difficult and challenging decision. Selling a business is also a pivot point for the business as well as in your personal life. This means you want to make sure that you not only make the best possible decisions for the future and continuity of your business, but that you also take care of your personal needs.

The exit process can be extremely complicated. So, when the time comes to sell your company, working with a trusted professional will ensure a smooth transition and that you are getting the maximum value for your business.

Developing an Exit Strategy

The first step in selling your business is to plan an exit strategy. An official exit strategy provides details on all the relevant operational, marketing, and financial information about your business. It also includes other details, such as assets, liabilities, cash flow, major accounts, employees, market analyses and trends.

Developing an exit strategy is not only important for documentation purposes, but it will also serve as an official form of communication to key personnel within your business. Many potential buyers and investors will ask to see a copy of the business’ exit strategy so that they can get a clearer picture of your business’ operations, financials, and even why you want to sell your business. In fact, most buyers will ask to see an exit strategy before they will even consider investing.

The Sales Process

During the sale process, entrepreneurs are often presented with key financial and emotional decisions, such as developing a financial plan and continuity plan, which involve collaborating with various stakeholders. The process often involves M&A advisors, broker dealers, insurance representatives, attorneys, estate planners and many more.

Working with various stakeholders can be overwhelming; therefore, working with a trusted professional to help you form a well-planned strategic process is of the utmost importance. A strategic sales process can mean the difference between a smooth transition, one that results in the maximum value for the business, and one that doesn’t.

Finding the Right Buyers

Potential buyers could be virtually anywhere. Most buyers are either financial buyers or strategic buyers. Financial buyers only look at the numbers and are strictly interested in the return on their investments. On the other hand, a strategic buyer has a greater motivation to buy the business as they most often have a greater vision for it. As a result, most strategic buyers are willing to pay more, especially if the business has a successful track record, and is in a position to further grow and develop.

Working with a professional M&A consultant can help your business target the right buyers to not only ensure a successful and timely transaction but to also ensure that you see maximum valuation for your business.

Maximizing Business Valuation

Most entrepreneurs have a number in mind that they want to receive before selling their business. However, much like selling or trading in a car, there’s not much an entrepreneur can do to increase the value of the business other than dramatically cut costs or increase sales prior to beginning the sales process.

However, a professional and experienced M&A consultant can help target the right buyers and boost interest and competition in order to increase the chances of buyers offering a price that hits the mark.

Selling the Business for the Highest Possible Price

Life events are called such because of their relative weighty significance in the broad scheme of life. They’re also relatively infrequent, which places further emphasis on their importance. Selling one’s privately-held business is one of of those “life events” not to dissimilar from marrying a child or graduating from grad school. As such, its importance should never be discounted. In fact, everything leading up to the sale should be considered the preparation before the harvest. Weeds are plucked, plants are watered, the garners are cleaned–everything is prepared for a very feverish but brief period when the business is ultimately sold. The struggle with most business owners is that they work in their businesses and not on them (a faint whispering deja vu from the fantastic book “The E-Myth Revisited”).

Most people don’t think about building a business they can sell. I want to lay out a few interesting points that I’ve found are extremely helpful in preparing your business for sale years before the event even happens.

Value-Realists

All good companies should perform a regular check-up on business value, if nothing more than to give shareholders a reality check.

I’ve a current client who runs a very successful services business, delivering expert solutions to the likes of MSFT & GOOG. However, his expectation on the payout he’ll receive for his company is highly unrealistic. In fact, here’s a direct quote from a conversation I had with him over lunch recently:

We’ve got such a great company, I would expect a strategic acquire would look at us much like Facebook looked at Instagram.

The anomalies on the fringes are so often far into the upper quartile that thinking the exceptions are the the rule can be dangerous. Maximizing your company’s value involves first knowing the value and then knowing the key components of taking it higher. My personal suggestion is a minimum of an annual assessment of company value. This will provide several key insights:

- Value Drivers. Understanding value — and particularly how it changes based on internal and macro forces — is extremely helpful when working to boost it.

- Real Expectations. When the actual time to sell the company arises, there’s less of a “oh, I thought my company was worth more than that.” Expectations are kept in check.

- Armor Chinks. Put simply, valuations can help expose the areas of greatest weakness, proving further insight into how improvements can be made.

Diversifying Your Customer Base

Each businesses with which we work has a different tail that wags the proverbial dog. Some companies operate with a very small client-base with sky-high margins, while others work in the arena of razor-thin, making up for the lack of margin by building a scalable enterprise. Regardless of the model, the product or the service being offered, every target becomes more inviting when the customer base is diversified. I’ll say it again differently and perhaps more clearly, a diversified customer base can significantly increase your business valuation.

The biggest downside to the company with a less-diversified customer-base in the inherent risk associated with a liquidity event. Companies with less diversified customer portfolios often run into extreme cash flow issues after deals are done and management has transitioned. It parallels the simple mantra of keeping too many eggs in a single basket.

The best private equity firms seek companies who have less downside risk by having no single client accounting for >10% of gross sales. In addition, having a multiplicity of customers across a broad swath of industries also helps to mitigate downside risk. Such companies have differing Betas and are less affected by similar economic conditions.

Customer Data: Understanding Your Clients

When potential acquirers arrive for due diligence chats with senior management, many business owners and entrepreneurs fail understand the depth to which investors may want to know about the client-base. Another way to increase your business valuation is to ensure you have an accurate understanding of the customers. Here are some fairly standard qualitative and quantitative measures for fully understanding a potentially complex customer ecosystem within your business.

- Understand gross revenue by customer for every time period, including months, quarters and years.

- Understand the competitive advantage of your customer-base. Can they be used for up-sell and cross-sell later?

- Follow and glean trends from customer databases, especially if you operate an eCommerce business looking to sell your company–this information should be more readily available from advanced CRM systems. If you don’t have such in place, include them in the business plan prior to prepping the company for sale.

- Know the sector(s) and region(s) you serve and understand how you do things differently and better than the competition.

- Pay close attention to accounts receivable (AR). Your AR will be very telling of the types of customers you have and the ones with which you may be struggling. Aged AR never looks good from the acquirer’s perspective.

Small Business Customer Concentration Issues

Perhaps one of the greatest flaws of small businesses looking to sell is the fact that many smaller companies have customer concentration issues. Addressing such value-detractors before attempting to find a qualified buyer for the company can help to significantly increase the value of the businesses, providing the entrepreneur with a much more gratifying liquidity event.

From the potential acquirer’s perspective, having any one customer account for greater than 10% of overall sales represents a large risk to the sustainable cash flow of the enterprise. Here are some considerations acquirer’s will want to know and potentially have mitigated prior to putting an offer on the business.

- What types of repercussion could be expected if a major customer jumped ship?

- What types of contractual agreements protect major customers from walking away after the transition of the company?

- Does the customer have an exclusive relationship with the company?

- Is there longevity of relationship with the customer which could prove dead once the business is sold?

- What type of co-dependence opportunities are in place with the customer (i.e. does the business service multiple locations and provide multiple products and services along the customer’s value chain?). In other words, who has the greater power, the customer or the supplier?

- Is the customer locked-in with some form of preferential contract or pricing obligation that would keep them from getting skittish if a deal were to be executed?

Diluting Customer Concentration Risk

Buyers will be concerned whenever there is too much customer concentration risk. It can significantly impact the value of the business and the acquirer’s desire to buy the company. Sometimes there are no easy ways to immediately reduce customer concentration risk. However, in some cases, focusing on growing sales and growing the customer-base is the best executable plan to mitigate customer concentration risk. This is a completely different discussion for a different time, but the bigger your customer-base, the less you have to worry about low valuations and lack of interest from potential buyers.

Top Drivers for Maximizing Company Valuations in M&A

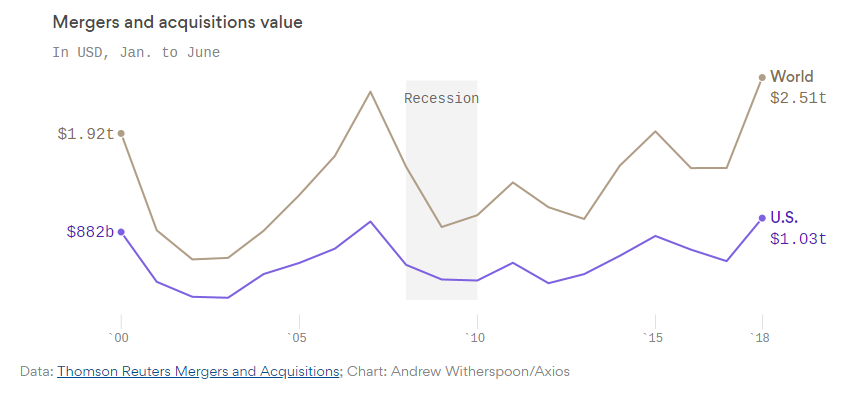

Merger and Acquisition (M&A) activity hit record highs in the United States and around the world during the first half of 2018. Energy & power, media & entertainment, and health care were the leading sectors in terms of deal value. For business owners who are considering selling their business or who have been approached by a willing buyer, a reasonable question would be “how do I increase the value of my business?”. With recent changes in tax laws, attractive valuations, and the potential for rising interest rates, now may be a good time to prepare your company to enter the market.

Business owners who recognize that it may be time to sell in the near future can take steps to help maximize their company’s valuation. In an ideal scenario, the business owner and key members of the management team would begin preparing for a sale well in advance (think 5+ years). Of key focus will be valuation drivers. These drivers are factors that can help increase cash flow to the business and reduce the risks associated with operating the company. Numerous drivers exist, and some will be industry specific. We will look at few drivers that are industry agnostic and can help increase your company’s valuation.

1. Customers

Every business needs them and yours is no exception. A well-diversified customer base can help increase the value of your business. Alternatively, a high percentage of revenues being derived from a small concentration of customers could be problematic. Allowing your business to become too dependent on your largest customers will raise red flags for a potential buyer. They will not be willing to pay a premium for a business that has increased risk.

As you prepare to enter the market it is important to identify if you have any customer concentration risk. A good question to ask is what percentage do the top 5 customers contribute to the company’s revenues? The top 10?

2. Human Capital

Just like your business wouldn’t be able to succeed without customers, it also requires a skilled workforce. The knowledge, talents, skills, experience, and creativity of your team are all valuable assets. While any buyer can be expected to spend ample time going through financials, an experience buyer will spend time with various members of the team.

You should identify any key personnel who have specific knowledge that the business depends on to continue operating. If you find that one or a few people, if removed from the operation, could cause the entire company to come to a halt, then it is time to start spreading the knowledge. Buyers will be hesitant to deploy capital if it only takes a few people leaving the company to cause serious trouble.

3. Technology/IP

Business owners should recognize that technology changes at an ever-increasing pace. It is important to dedicate resources to R&D and to be catering to the developing needs of customers to ensure the company stays relevant. Once you realize that you are behind your competitors it will be difficult to keep up.

Expect buyers to inquire into your R&D practices and expenditures. They will want to see that your company has been able to change with the times and, even better, be at the forefront of new technological shifts. Admittedly, for smaller companies with tighter budgets it may be difficult to allocate the necessary resources to R&D. Developing strategic partnerships can help bridge the gap and keep the company up-to-date with their products and services.

4. Products & Services

Products and services require R&D, as previously discussed, and diversification. Some smaller companies may find themselves offering only one or two products or services. This could put them at risk of losing current customers or new business prospects due to policies that require the company to deal with vendors who offer a wide range of products. Similar to the diversification in customers, your product line should not consist of one or two items.

As buyers analyze your company they will check if your product line is diversified, if the products are exposed to economic swings, and opportunities that exist for vertical or horizontal integration.

5. Company Roadmap

Having a budget and strategy for the next year is great. However, having a roadmap outlining where the company will be in five years and how they will get there is even better. Sellers should remember that valuation exercises look to the future and expectations of how the company will perform. Having a strategic plan that can be passed to a new owner that can help assure them that the business will continue and could even grow will be critical.

6. Financial Performance and Metrics

It would be difficult to discuss valuation without bringing up financials. Buyers will look at data including financial statements, trend analysis, and margins. It is important to show growth in areas such as revenue and improvements in margins, such as EBITDA. It should also be expected that buyers won’t look at your company alone. They will want to know how you compare to competitors. Growing revenues at 3% YoY may be good, but if your competitors are all growing revenues at 6% YoY then you may have a problem.

While your company may employ an internal accountant, having your financials reviewed by an external CPA will help make buyers more comfortable. If it makes sense, audited financials are even better. Finally, having financial controls in place is one more sign to a potential buyer that you are serious about keeping your company in order.

It should be stressed that the above are by no means an exhaustive list of valuation drivers. These should serve as a starting point for business owners who are considering selling their business. Once the appropriate drivers have been identified it is necessary to constantly be reviewing and improving them. If you are unsure of how to value your business, it could well be worth the cost and effort to work with experienced valuation experts to understand the real intrinsic value of your company. In another article, we discuss the importance of always keeping your business valuation current.

Doing the Deal

I had a wise friend once tell me-after he sold his business for about $7M:

The most money you will ever make is during negotiations.

ROI maximization in mergers & acquisitions is best performed by enhanced negotiation techniques. Each good deal-maker has their own methodology. Here are my personal steps for reaping the most out of one of the most important life events you may have.

- Clean it up. I have a great contact within my network here in the Seattle area who is the CFO of a $1B privately-held company. Since becoming the CFO, he informed me that his entire job there is to make the financials so flawless that when it comes time to sell the company in the next couple of years, they’ll be able to get top dollar. Lamborghinis sure look nice, but the real sexy part is when you can take a look under the hood when the engine is revving. The same holds true for any business that truly churns out the cash.

- Make it presentable. Of course, buffing the exterior is also helpful. That includes alignment of goals and strategy with employees, partners, suppliers and customers. A well-oiled machine is more than just window dressing a balance sheet or cleaning up the income statement. Putting your ducks in order also helps in greasing the skids in due diligence.

- Source and market to strategic buyers over financial buyers. Holding out for strategic buyers is a strategy that can increase your payout by double-digit percentages. There are a couple of good articles outlining the difference. You can find them here and here.

- Treat it like an auction. When it comes to buying furniture or cars, auctions can produce some excellent deals for potential buyers. Selling businesses is a whole different ball game. Auctions tend to produce premium purchases. In an auction scenario like this, the sellers are not auctioning off a commodity, but a company that typically provides superb cash-flows can command a premium price, especially if it represents a 2 + 2 = 5 performance scenario for a strategic acquirer.

Here’s a specific example. A recent client was looking to sell his business. The company was kicking out about $2M EBITDA annually. It was a good little business that had been in the family for over 50 years. The original owners were in their 90s and the current owner/manager was looking to retire himself. It was time to sell. Luckily, he had done a very good job on steps 1 and 2 above. We brought multiple strategic buyers to the table in a structured and time-sensitive auction. When the dust finally settled and the two remaining strategics were done battling over the company, the final closure price was a 40% premium over our initial valuation for the firm. The win for the owners could not have been overemphasized.

Unfortunately, some life events will never be easy to plan for. Some are sudden and unexpected, like the death of a loved-one. For those strategically deliberate events, a healthy dose of realism and massive binge of preparation will be essential to ensure the best possible outcome. While there is some luck to success and achievement, a big part of it is is completely deliberate. Make your deliberate impact when it counts the most.

Sources

[1] Primack, D. (2018, July 05). Corporate M&A activity hits all-time high. Retrieved August 9, 2018, from https://www.axios.com/mergers-and-acquisitions-all-time-high-first-half-2018-5fde1567-0b81-44d9-b438-42c250681399.html