2020 was an unpredictable and unique year for the global economy. The effects of the pandemic stretched farther than the illness itself. The economy, especially at the middle market level, saw increased amounts of volatility and a decreased amount of spending.

This led to many local firms going bankrupt and a rise in unemployment. The COVID-19 virus also had a major effect on the Mergers and Acquisitions market. Now that we are a ways into 2021, the market anticipates effective vaccines will set things back on track.

We can learn a lot, however, about the M&A market over the course of 2020 when the virus was at its peak.

Stats & Analysis

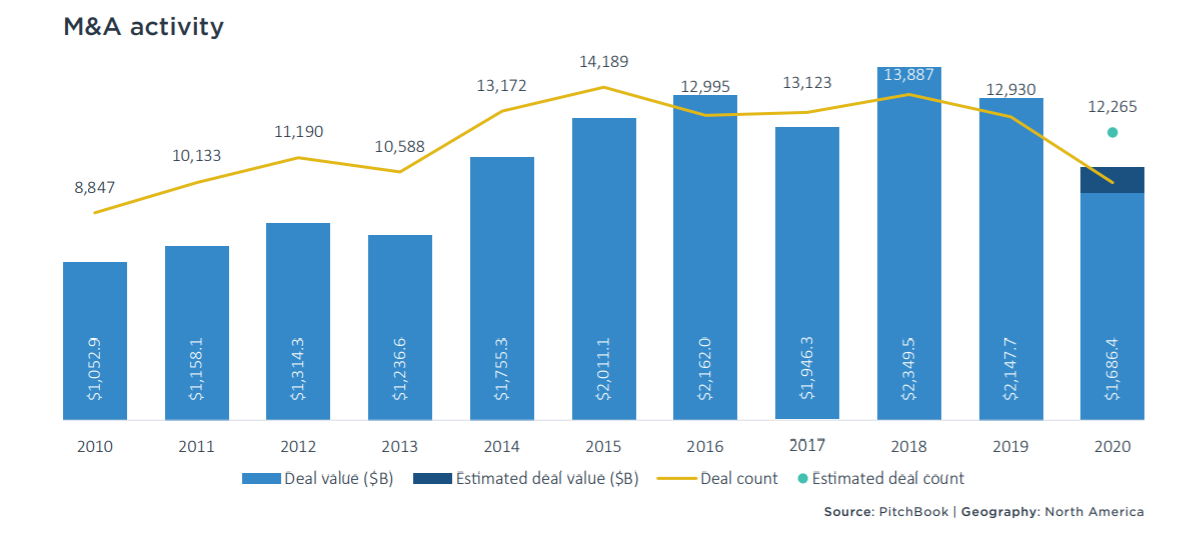

Merger and acquisition deal count in 2019 was down from 2018, so expectations coming into 2020 already accepted the possibility of a slower year. But no one could have foreseen the economic downturn that was coming due to the pandemic.

Covid-19 dramatically cut M&A deal volume. Many U.S. businesses suffered during 2020. Firms that had hoped to expand chose instead to invest less and hold off on their plans. Due to government mandates, many companies had to close their doors for most of the year.

Small and middle-market firms reported some of the greatest losses because in most cases their operations were deemed “non-essential” and therefore had to cease. Government stimulus payments and PPP loans kept some of these companies afloat and enabled them to continue to pay their employees.

But as 2020 continued and understanding of the virus and hopes for an effective vaccine grew, companies tried to resume normal activities, which lead to more M&A deals in the latter part of the year (2).

Data shows that middle-level firms experienced dramatic decreases in deal volume. An increased amount of uncertainty about the future and the effectiveness of the vaccine encouraged less volume in the market. More companies have held back funds until the market seemed more stable.

Firms that continued to search for buy-and-sell side deals faced problems with completing due diligence due to a lack of in-person management and travel restrictions (1). One of the most significant challenges came from tighter restrictions on accessing the debt market.

Even though the Fed lowered the reserve rate for U.S. banks to 0% to increase the amount of money that could be lent, banks and other lenders have had to become stricter on loan qualifications. This caused problems for some individuals and businesses who sought to close M&A deals (1).

Despite the unexpected downturn, the Fed adopted several tactics to help the economy rebound. According to reports, the Fed purchased corporate debt, ETFs backed by highly rated bonds, Treasuries, agency mortgage-backed securities, and other items (1). This helped the economy to stay afloat and begin its slow recovery.

The Fed also provided more liquidity to the market to give companies and individuals more funds to invest and stimulate growth. However, the economy continues to suffer, with millions of Americans unemployed and certain firms still unable to reopen.

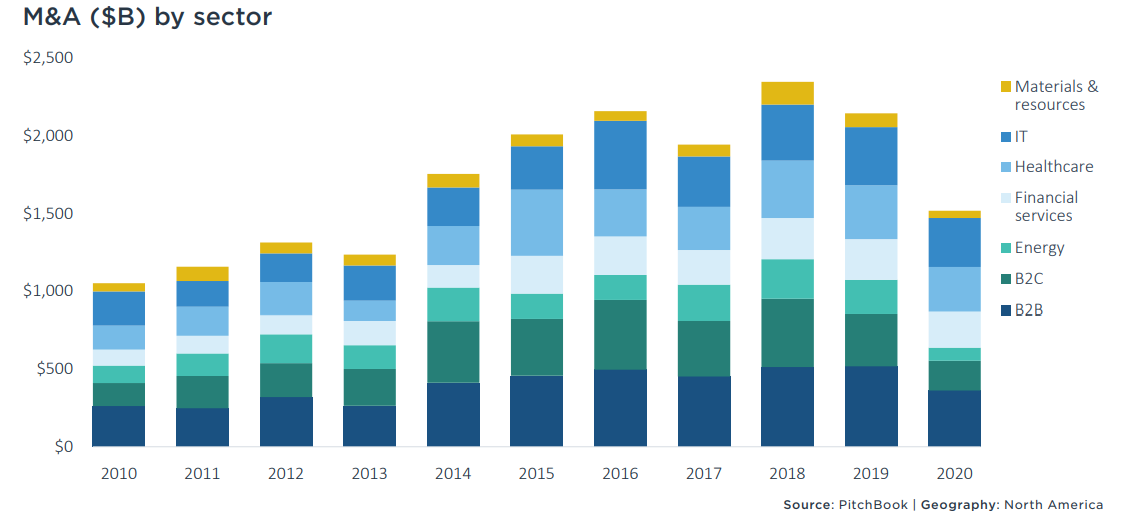

As often happens, when some areas of the economy are struggling, others thrive. The pandemic has created an even larger demand in the technology sector.

More businesses are having their employees work from home, resulting in a greater need for communication technology and software, such as Zoom, that employees can use on their home computers. The technology, media, and telecommunications sectors saw an increase in deals by about 6% from 2019 — with 5,755 deals valued at $973 billion dollars (2).

M&A activity in the financial services sector was strong in 2020. The sector had a great finish in quarter 4, to reach $232.5 billion in deal value. The financial services market made up 15.3% of overall M&A deal volume.

It has not taken up this much of total M&A activity since 2009 (1). Among the bigger deals were Charles Schwab’s $22.0 billion takeover of TD Ameritrade, and Morgan Stanley’s $13.0 billion takeover of E*TRADE. “These scale-driven combinations are bets that discount brokerage customers can be upsold to more profitable asset management services” (1).

As can be read in the graph above, the healthcare industry represented a massive portion of deal activity. Healthcare deals had a huge fourth quarter, with the median deal size reaching $57.4 billion, the highest since 2006. (1)

This was not a surprise to many. People looked to the healthcare industry for answers and for help to slow the spread and effects of Coronavirus. The 2020 Annual North American MA report noted that “Transactions involving both inpatient and outpatient care facilities ticked up significantly in Q4, as continuing financial pressure caused by the elective procedures delay made more practice owners amenable to acquisitions.” (1)

Some hospitals and family doctors encouraged people to postpone elective surgery and accommodate for the larger number of patients who were sick with the virus. This led to massive revenue decreases for these healthcare providers.

Many Americans still are not going for elective surgeries due to fear of getting infected. Hospitals and private clinics look forward to the vaccine being effective in stopping the spread of the virus so they can refocus on elective surgeries and increasing profits.

But for those with the capital, this was a great time to transact deals in the healthcare industry and get their foot in the door while the market was down. COVID-19 has also showed the world its critical need for advanced healthcare to create new vaccines quickly, and achieve other medical breakthroughs to combat future pandemics or respond to other health-related emergencies.

Future Expectations

Although COVID-19 has driven a tragic turn of events and been extremely hard on businesses and families around the world, it has been eye-opening to see which industries have managed to stay afloat during a pandemic. Going forward, investors would be wise always to factor in the potential for another pandemic-like scenario.

Certain entertainment activities — for example, movie theaters — may never fully recover. Consumers are changing and adapting the way they do things. More people are streaming at home now than ever.

Trends like this could drive M&A activity away from those industries. However, firms and businesses are now better prepared for similar scenarios going forward.

Many businesses have upgraded their software and are thinking about having their employees work from home as more permanent solution. Companies looking to engage in M&A deals should evaluate how certain industries are affected and respond to future potential threats before investing.

During 2020 certain operations also started looking into alternatives to mergers and acquisitions. For example, several firms chose to purchase smaller stakes within companies they were interested in merging with to minimize risk but still make strategic moves (4).

This could become a more popular strategy over the near future, since companies remain hesitant about future economic conditions. Minority deals do not allow for the same amount of expansion and growth that full M&A activity can bring, however.

Firms looking to break into new markets or gain a more significant competitive advantage may still want to focus on M&A activity. Alternative deals also tend to have a low success rate, which could become harmful to companies that expect to minimize risk (4). Thus, while some firms may have had greater success during 2020 with minority deals, M&A activity continues to be a central activity of the market.

The future of M&A activity looks reasonably profitable and bright. Andrea Guerzoni, EY Global Vice Chair-Strategy and Transactions, said: “An increase in activity in the second half of the year was largely expected, but the rebound in global M&A following the COVID-19 pandemic related stall has been stronger, quicker, and more sustained than many could foresee. There has been a boldness in the deals announced post-July with the aim to combine assets to offer a broader and deeper array of products and services to customers being the common thread.

“As businesses look to build resilience to withstand any future shocks or crises, transactions across all sectors have focused on capturing long sought-after capabilities and building new routes to market, rather than capturing market share.” (2) Investors should expect an exciting and high-volume deal count for 2021.

With more people getting vaccinated every day, the economy and markets continue to recover, and most analysts predict healthy growth going forward. (5) Due to 2021 starting with low interest rates, increased amounts of funding, less volatility, and apparently effective vaccines, M&A deals have the perfect springboard to proceed to make 2021 a profitable and high-volume year.

Richard Su contributed to this report.

Sources

- Pitchbook. (February 6, 2021). 2020 Annual North American MA Report. Retrieved from https://files.pitchbook.com/website/files/pdf/PitchBook_2020_Annual_North_American_MA_Report.pdf

- EY. (December 14, 2020). Conditions ripe for already resilient M&A activity to accelerate in 2021 and beyond. Retrieved from https://www.ey.com/en_gl/news/2020/12/conditions-ripe-for-already-resilient-m-and-a-activity-to-accelerate-in-2021-and-beyond

- Morrison Foerster. (January 15, 2021). M&A In 2020 And Trends For 2021. Retrieved from https://www.jdsupra.com/legalnews/m-a-in-2020-and-trends-for-2021-7116897/

- Kengelbach, Jens. Keienburg, George. Degen, Dominik. Söllner, Tobias. Kashyrkin, Anton. Sievers, Sönke. (September 29, 2020). The 2020 M&A Report: Alternative Deals Gain Traction. Retrieved from https://www.bcg.com/publications/2020/mergers-acquisitions-report-alternative-deals-gain-traction

- Derby, Michael. (April 7, 2021). Fed’s Kaplan Says the Economy Still Needs Central Bank Support. Retrieved from the Wall Street Journal https://www.wsj.com/articles/feds-kaplan-says-the-economy-still-needs-central-bank-support-11617787800