IT services and MSPs sit at the center of enterprise cloud, security, and AI adoption. Since 2021 the market has moved from a stimulus-boosted surge to a financing-led slowdown (2023) and into a 2024–2025 rebound aided by improving credit and record private-market capital deployment in certain pockets. Private markets activity remained uneven in 2024, but dealmaking and financing conditions improved and entry multiples ticked up alongside better credit availability, setting the stage for more sponsor-backed service roll-ups and carve-outs in 2025–26. McKinsey & Company

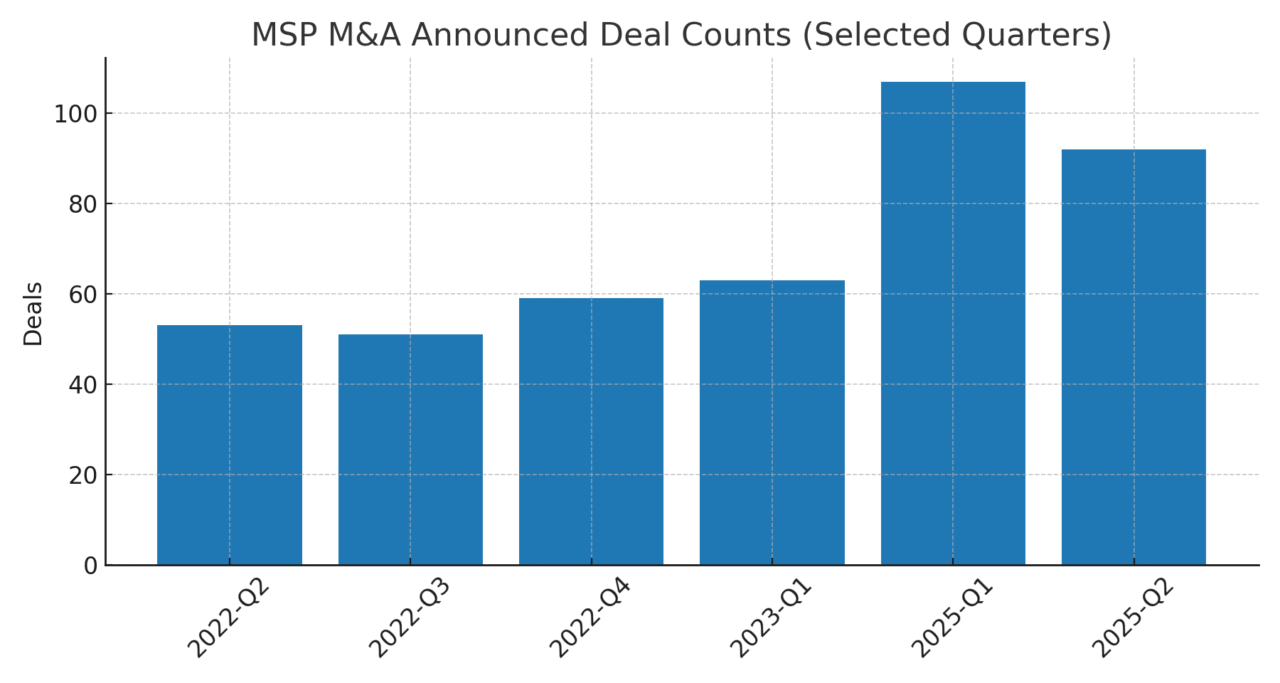

Recent M&A momentum. Within MSPs specifically, announced deal volumes show continued consolidation: 2025 Q1 recorded 107 transactions and 2025 Q2 had 92 (Drake Star), while earlier snapshots show 59 (Q4’22) and 63 (Q1’23) MSP deals (Founders). DrakeStarHubSpot

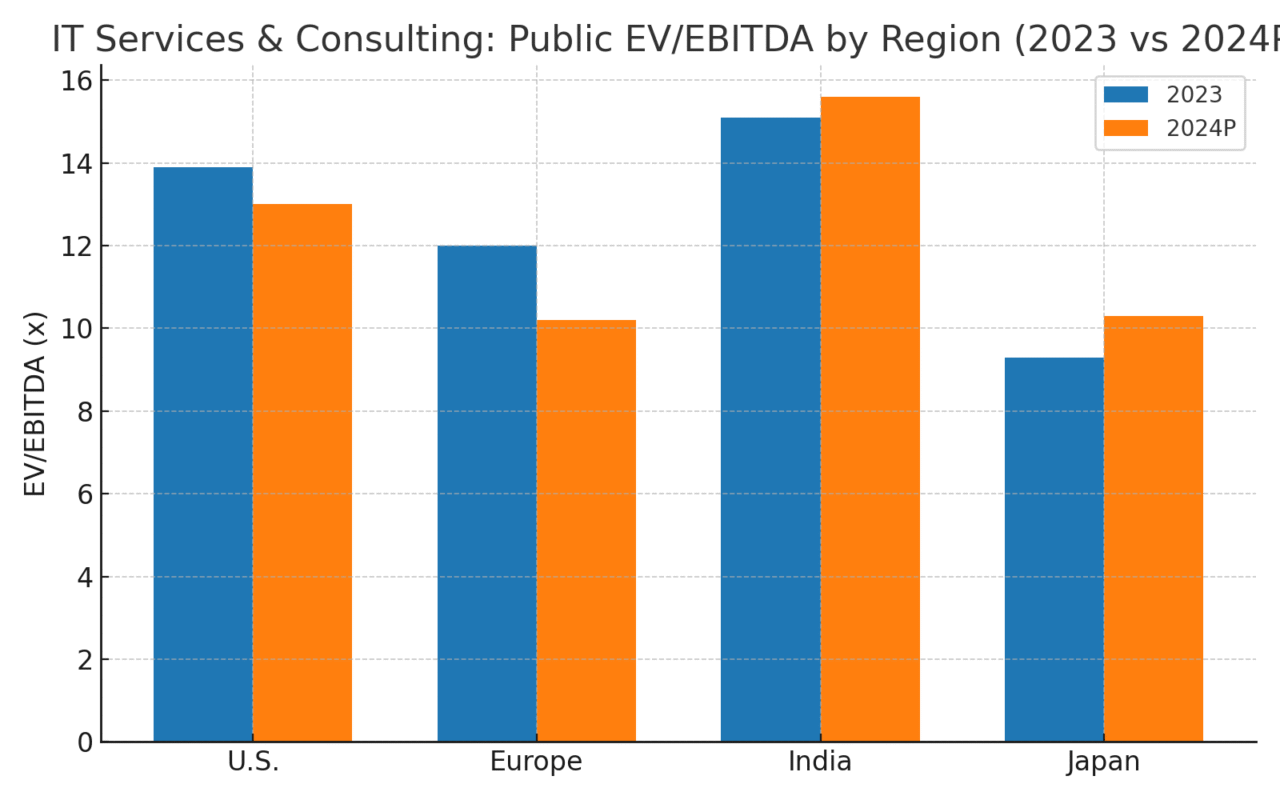

Valuation snapshot. Public IT Services & Consulting EV/EBITDA medians (2024P) cluster around 10–16x depending on region—U.S. ~13.0x, Europe ~10.2x, India ~15.6x, Japan ~10.3x—per Harris Williams’ Q2’24 comp set.

Who’s buying? Strategics are active (e.g., Accenture: 39 acquisitions in 2024; IBM: Apptio (2023) and HashiCorp (announced 2024, closed 2025); Insight Enterprises: SADA (2023); CDW: Sirius (2021)). Sponsors continue fueling MSP platform roll-ups and add-ons. CRNIBM Newsroom+1investor.insight.comSEC

Key trends. AI services, managed security (MDR/XDR), cloud FinOps/automation, and multi-cloud governance top investment theses; regulatory scrutiny is rising in software but remains manageable for services (IBM–HashiCorp cleared in the U.K. in Feb 2025). DrakeStarHubSpotReuters

| Key Metric | Value |

|---|---|

| Public EV/EBITDA (2024P), by region |

|

| Public EV/Revenue (2024P), by region |

|

| MSP M&A — announced deal counts (selected quarters) |

|

| Representative disclosed deals (USD) |

|

Industry M&A Market Overview

Deal activity (Y/Y & Q/Q).

-

MSP consolidation: 107 announced deals (Q1’25) → 92 (Q2’25), indicating high but normalizing velocity after a strong start. Our chart includes earlier reference points from late 2022–early 2023. DrakeStarHubSpot

-

Digital & IT consulting: Large-cap strategics kept up a steady cadence of tuck-ins (Accenture alone executed ~39 acquisitions in 2024). CRN

Notable megadeals (2021–2025):

-

Hitachi → GlobalLogic ($9.6B, 2021) to scale digital engineering (high-teens to ~30x EBITDA narrative). PR Newswire

-

CDW → Sirius ($2.5B, 2021) to boost solutions & managed services scale. SEC

-

Kaseya (Insight-led) → Datto ($6.2B, 2022) consolidating MSP tooling. Kaseya

-

IBM → Apptio ($4.6B, 2023) adding IT spend mgmt/FinOps software to services/software stack. IBM Newsroom

-

IBM → HashiCorp ($6.4B, announced 2024; closed Feb 27, 2025) to create an end-to-end hybrid cloud platform. IBM Newsroom+1

-

Insight Enterprises → SADA (2023) Google Cloud consultancy for multicloud depth. investor.insight.com

PE vs. strategics. Strategics remain highly active in services (Accenture, IBM, CDW, Insight). PE is a major force behind MSP roll-ups and add-ons; Drake Star shows 100+ quarterly MSP deals in early 2025, with both strategic and financial buyers participating. DrakeStar

Capital availability. Financing conditions improved through 2024, with private debt steady and entry multiples rising from 2023 lows; capital deployment increased even as fundraising softened—supporting renewed deal flow into 2025. McKinsey & Company

-

Bar chart: M&A volume for MSPs (selected quarters 2022–2025)

-

Global hotspots: U.S./Europe remain largest pools; India-based public comps command premium multiples (see Section 3).

Valuation Multiples & Comps

Public medians (Q2’24):

-

EV/EBITDA (2024P): U.S. 13.0x; Europe 10.2x; India 15.6x; Japan 10.3x.

-

EV/Revenue (2024P): U.S. 2.1x; Europe 1.7x; India 3.2x; Japan 1.4x.

Source: Harris Williams Technology Services Q2 2024 (public comparables methodology and peer sets therein).

Private-market deal multiples. A broad sample of 480 IT services transactions (2015–2022) shows a median EV/EBITDA ≈11.4x, with top-tier digital engineering and data/AI consultancies often commanding higher-teens. (Contextual benchmark; deal terms vary widely by growth/mix/retention.) KPMG

5-year public barometer (illustrative): Some sell-side sector work pegs 5-year averages around ~3.0x EV/Revenue and ~18x EV/EBITDA for select “quality” IT services cohorts, highlighting the premium for scale, growth, and margin durability (interpret cautiously; cohorts differ). Morgan Partners

-

Line/bar: Historical valuation medians by region (2023 vs. 2024P)

-

Comps table: Use the Harris Williams peer group for tickers; medians provided above.

| Region | EV/Revenue (2023) | EV/Revenue (2024P) | EV/EBITDA (2023) | EV/EBITDA (2024P) |

|---|---|---|---|---|

| U.S. | 2.0× | 2.1× | 13.9× | 13.0× |

| Europe | 2.0× | 1.7× | 12.0× | 10.2× |

| India | 3.2× | 3.2× | 15.1× | 15.6× |

| Japan | 1.3× | 1.4× | 9.3× | 10.3× |

Notes/Sources: Medians and peer groups are taken directly from Harris Williams — Technology Services Sector Brief (Q2 2024); figures reflect S&P Capital IQ data “as of May 17, 2024,” per the report. Contentful

Top Strategic Acquirers & Investors (2023–2025)

Strategic acquirers (examples & theses):

-

Accenture — 39 deals in 2024; focus on cloud, data & AI, cyber, and industry vertical depth. CRN

-

IBM — Platform+consulting flywheel (Apptio 2023; HashiCorp announced 2024, closed 2025) to strengthen hybrid cloud automation & governance. IBM Newsroom+2IBM Newsroom+2

-

Insight Enterprises — SADA (Google Cloud specialist) to deepen multicloud services at scale. investor.insight.comCRN

-

CDW — Sirius (solutions integrator/MSP scale) to expand services mix. SEC

-

Wipro — Rizing (SAP) to bolster enterprise applications consulting. Consulting.us

-

Capgemini / CGI / NTT DATA — steady programmatic M&A in niche capabilities (e.g., Apisero by NTT DATA in ’22; Umanis by CGI in ’22). Private Equity Stakeholder Project PESPCapstone Partners

PE platforms & roll-ups (illustrative): Evergreen Services Group, The 20 MSP, and numerous sponsor-backed MSP platforms continue bolt-ons across North America and Europe; Drake Star tracks ~100 MSP deals per quarter in early 2025, underscoring the breadth of sponsor activity. DrakeStarIT Managed Services

| Date | Acquirer | Target | EV (USD) | Subsector | Rationale | Notes |

|---|---|---|---|---|---|---|

| 2021-07-14 | Hitachi | GlobalLogic | $9.6B | Digital engineering / IT services | Scale digital engineering capabilities and accelerate digital transformation services | EV multiple ~29.4× 2022E EBITDA per Hitachi disclosure |

| 2021-10-18 | CDW | Sirius Computer Solutions | $2.5B | Solutions integrator & managed services | Accelerate services mix across hybrid infrastructure, security, cloud & managed services | |

| 2022-04-11 | Kaseya (Insight Partners-led) | Datto | $6.2B | MSP software/tools (BCDR, RMM, PSA) | Expand end-to-end toolset for MSPs; scale channel reach | 52% premium to unaffected price |

| 2022-04-26 | Wipro | Rizing | $540M | SAP consulting | Deepen SAP transformation capabilities across industries | |

| 2023-07-27 | IBM | Apptio | $4.6B | IT spend mgmt / FinOps software | Enhance hybrid cloud & automation platform; pair with Turbonomic/Instana | Closed 2023 |

| 2023-12-01 | Insight Enterprises | SADA | $410M | Google Cloud consultancy (MSP/CSP) | Strengthen multi-cloud solutions integrator model; expand Google Cloud depth | Earnout up to $390M; implied EV/EBITDA ~11× on target earnout |

| 2024-04-24 (closed 2025-02-27) |

IBM | HashiCorp | $6.4B | Cloud infrastructure automation | Create end-to-end hybrid cloud platform; deepen multi-cloud automation | Closed Feb 27, 2025 |

Transaction Case Studies

-

Hitachi → GlobalLogic ($9.6B, 2021) — strategic scale-up in digital engineering; widely reported premium multiple (~29x 2022E EBITDA) reflecting growth quality. PR Newswire

-

Kaseya → Datto ($6.2B, 2022) — MSP toolchain consolidation; 52% premium to unaffected price; channel synergy thesis. Kaseya

-

IBM → Apptio ($4.6B, 2023) — expands IT spend mgmt/FinOps & automation stack supporting IBM Consulting. IBM Newsroom

-

IBM → HashiCorp ($6.4B; announced 2024, closed Feb 27, 2025) — end-to-end hybrid cloud platform (Terraform + Red Hat + Consulting). U.K. CMA cleared in Feb 2025. IBM Newsroom+1Reuters

Valuation Framework & Modeling

When large firms buy IT services companies or managed service providers (MSPs), they need to figure out “what is this business worth?” Bankers and corporate development teams use several approaches, each with different strengths:

1. Comparable Company Analysis (“Trading Comps”)

-

What it is: Look at how the stock market values similar publicly traded IT services firms.

-

How it’s used: If companies like Accenture or Wipro trade at, say, 13× EBITDA, then a smaller but similar company might be valued in that ballpark, adjusted for growth, margins, and risk.

-

Why it matters: This sets an anchor point for negotiations—it tells buyers what the market would likely pay.

2. Precedent Transaction Analysis (“Deal Comps”)

-

What it is: Examine what other buyers actually paid in past M&A deals for similar businesses.

-

Example: IBM paid about $4.6B for Apptio (~11–12× EBITDA). That provides a real-world benchmark.

-

Why it matters: Unlike stock market comps, this shows what buyers were willing to pay to gain control—often at a premium.

3. Discounted Cash Flow (DCF)

-

What it is: Forecast the company’s future cash flows (profits after reinvestment) and “discount” them back to today’s dollars using a cost of capital (like an interest rate adjusted for risk).

-

Why it matters: This tells you what the business is worth based on its ability to generate cash in the future, not just market multiples.

-

Plain analogy: Imagine buying a rental property—you estimate future rents and subtract expenses, then figure out what that’s worth today.

4. Control Premiums

-

What it is: Buyers usually pay more than the stock market price (often 20–30%) to acquire full control of a company.

-

Why: Owning 100% means you can make strategic changes—merge operations, cut costs, or cross-sell services.

5. Key Drivers for IT Services & MSPs

Buyers look carefully at a few recurring factors that swing valuation:

-

Recurring vs. one-time revenue: MSPs with subscription-like revenue (managed security, cloud hosting) are more valuable than those dependent on one-off projects.

-

Margins & scalability: Higher EBITDA margins and offshore delivery leverage boost value.

-

Growth rate: Faster-growing firms usually command higher multiples.

-

Synergy potential: Acquirers often justify a higher price if they can save costs (e.g., merging service desks) or increase sales (e.g., cross-selling cloud security).

6. Modeling in Practice

-

Bankers build sensitivity tables: e.g., “If we pay 12× EBITDA and the target grows 10% vs. 15%, what’s the IRR (return)?”

-

They test different WACC (discount rates), exit multiples, and synergy cases to see what ranges still work.

-

For sponsors (private equity): they also run quick LBO (leveraged buyout) screens to check if debt financing still delivers the required 20%+ IRR.

Simplified Example (Non-Advisory):

Suppose an MSP makes $20M in EBITDA. Similar public firms trade at 12×, and precedent deals show 11–13×. A buyer might:

-

Start with 12× = $240M “fair” value.

-

Add a 20% control premium = ~$288M.

-

If they see $10M in cost savings through integration, they may justify stretching to $300M+.

Disclaimer: These are general frameworks—not specific advice. Actual valuations depend on the exact financials, competitive position, and negotiation dynamics of each deal.

Trends & Strategic Themes

-

AI Services flywheel. Buyers seek data engineering, MLOps and model governance, and AI-enabled productivity in delivery (code gen, copilots). Expect premium multiples for firms with provable AI-driven margin lift and IP. McKinsey & Company

-

Managed security convergence. MSPs are acquiring or partnering for MDR/XDR and identity. Consolidators prize cyber capabilities that uplift ARPU and stickiness. (Drake Star MSP theses.) DrakeStar

-

Cloud FinOps and automation. Apptio (IBM) and HashiCorp illustrate the “operate” layer as a consolidation magnet (governance/FinOps/automation). IBM Newsroom+1

-

Programmatic M&A at scale. Accenture’s steady cadence shows the enduring advantage of systematic capability buys vs. one-off bets. CRN

-

Antitrust tailwinds for services. Large software deals face scrutiny; pure services integrations typically clear with minimal remedies (IBM–HashiCorp cleared by CMA). Reuters

2025–26 Market Outlook

Drivers. Better financing tone vs. 2023, PE exit backlog, hyperscaler/AI demand, cyber risk, and cost-to-serve pressure favor scaled integrators/MSPs. McKinsey & Company

Headwinds. Wage/margin pressure in high-cost markets, longer enterprise sales cycles in discretionary consulting, and tighter diligence on inorganic synergy realization.

Buy-side priorities (funnel):

-

Must have: Cyber (MDR/XDR), data platforms/AI, cloud automation/FinOps, ServiceNow/SAP transformations.

-

Selective: Industry-specialist MSPs (healthcare/energy/public sector), app modernization factories, nearshore delivery.

-

Opportunistic: Turnaround SI assets, legacy infrastructure-heavy MSPs without cyber/automation uplift.

Appendices & Citations

Deal tables & visuals: See CSV/PNG downloads at the top.

Methodology (high level): Public comps and regional multiples from sell-side sector work; MSP quarterly volumes from Drake Star reports; additional deal facts from company press releases, SEC filings, and reputable trade press. Where ranges are shown, they reflect rolling medians or well-cited industry samples.

Key Sources (linked throughout):

-

Harris Williams, Technology Services Q2 2024 (public comps).

-

Drake Star, MSP Reports Q1 & Q2 2025 (deal volumes & themes). DrakeStarHubSpot

-

Founders Advisors, MSP Update (Q4 2024) — historical quarterly MSP counts (late 2022–early 2023).

-

McKinsey, Global Private Markets Report 2025 — financing/deployment context. McKinsey & Company

-

CDW–Sirius (SEC Exhibit 99.1). SEC

-

Kaseya–Datto ($6.2B). Kaseya

-

IBM–Apptio ($4.6B). IBM Newsroom

-

IBM–HashiCorp ($6.4B; announce & close; CMA clearance). IBM Newsroom+1Reuters

-

Insight–SADA (price, earnout, strategy). investor.insight.comCRNQ4cdn

-

Wipro–Rizing ($540M). Consulting.us

-

Hitachi–GlobalLogic ($9.6B). PR Newswire

-

Private deal EV/EBITDA median reference. KPMG

Expert Commentary

Green signals (favorable)

-

Scale MSPs with cyber + automation bundles and >110% NRR; delivery leverage (near/offs.hore) without quality leakage.

-

Operate-layer capabilities (FinOps, platform engineering, IaC) that reduce customer cloud TCO and lock in multi-year managed contracts.

-

Programmatic acquirers with proven integration factories and cross-sell engines (case in point: Accenture playbook). CRN

Red signals (caution)

-

Pure staff-aug without IP or industry depth; sub-scale MSPs lacking cyber attach.

-

Heavy legacy infrastructure exposure without a modernization path.

-

Over-reliance on M&A to hit growth targets amid tighter synergy underwriting.

Checklist — targeted diligence for IT Services/MSP

-

Revenue mix (recurring managed vs. project); NRR, churn, cohort health

-

Gross margin bridge (L1/L2/L3 support, tooling, security attach) → EBITDA flow-through

-

Delivery model (utilization, pyramid, offshore %, attrition, bill rates)

-

Security posture (MDR/XDR stack, incident history, cyber insurance)

-

Tooling/automation (RMM/PSA standardization, IaC, FinOps)

-

Customer concentration & regulated verticals (HIPAA, PCI, CJIS, etc.)

-

Integration capacity (playbooks, systems, PMO) and realized synergies from prior add-ons

Disclaimers

This material is for research/information purposes only and not investment, legal, accounting, or tax advice. All third-party trademarks and data are the property of their respective owners; sources are linked. Figures are based on publicly available reports and may differ from proprietary databases.