Investing money is essential in today’s financial world, and setting clear investment objectives can determine whether investments are successful.

While each investor possesses unique goals with particular approaches to entry and exit strategies, five of the most common overall objectives remain the same: capital preservation, wealth accumulation, retirement planning, income generation, and risk tolerance.

This quick guide will provide a valuable overview of these five different investment objectives with an explanation of certain methods or tools used to help reach established goals.

Once these essential elements have been discussed, it would hopefully encourage readers to research their own individual needs so they can follow strategies personally tailored to one’s risk purpose.

1. Capital Preservation

Capital preservation is an investment strategy focused on minimizing potential losses. Capital preservation helps protect your stocks, bonds, or other investments from a market downturn while lmiiting the risk of capital loss.

It requires keeping one’s portfolio in safe and stable assets such as government bonds and treasury bills that typically earn below-average returns but are less volatile than mutual funds or company stocks.

The idea behind this approach is to keep cash savings insulated from significant market fluctuations so they remain intact when financial markets enter periods of instability. With capital preservation strategies investors can defend their money and safeguard it against sudden economic collapses without sacrificing all opportunities for yield over time.

Examples of low-risk investment

Capital preservation is the investment objective of maintaining an original investment’s value. It involves minimizing or avoiding risk and focusing on safeguarding your capital, rather than expecting it to grow over time.

Common examples of low-risk investments suitable for capital preservation include money market accounts, government bonds (Treasury notes or bonds), corporate bonds, certificates of deposit (CDs), and short-term bond funds. All carry different degrees of income benefits in a savings environment backed by FDIC insurance as protection against price volatility.

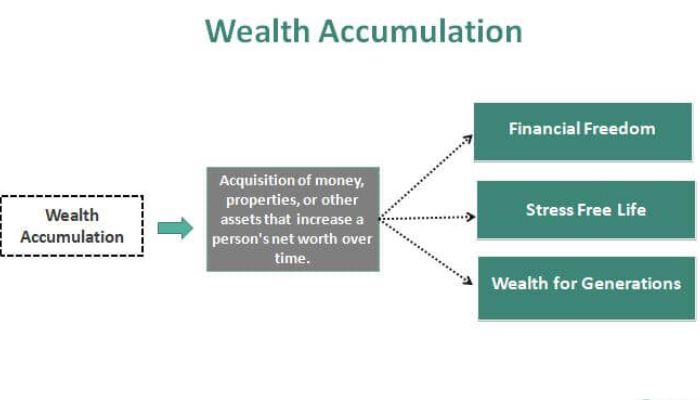

2. Wealth Accumulation

Wealth accumulation is a common investment goal characterized by an overall increase in financial assets over time. It can be accomplished through high-return trading, low-cost investments, or a focus on personal savings practices. Investing money into stocks, bonds and mutual funds where it has the potential to gain compound interest is often popular for long-term wealth accumulation strategies.

Investment vehicles that generate capital appreciation such as real estate or private business endeavors are also popular choices amongst investors aiming at building their wealth steadily over time. With consistent, informed decisions about individual risk tolerance and suitable asset types, consistent wealth growth can be achieved with minimal effort and hassle overtime.

Various investment in wealth accumulation

When it comes to investing with the goal of wealth accumulation, there are plenty of options available depending on one’s individual goals and risk tolerance. Stocks and mutual funds can provide opportunities for long-term appreciation, while bonds offer a steady stream of regular income as well as capital preservation.

A portfolio that includes domestic and international assets can offer even greater diversification. Real estate investments such as rental properties or private mortgages also make great additions to a wealth accumulation plan.

Depending on the scope of one’s investment activities, other more speculative types of investments such as commodities, derivatives, direct ownership in private firms, hedge funds or structured products may present profitable opportunities for investors willing to take measured risks when it appears reasonable based on market conditions.

3. Retirement Planning

Retirement planning as an investment objective refers to setting and achieving a future financial goal that provides for retirement income when you cease working. It means saving enough independent of other income sources, when your own personal income ends (from working or other invested funds).

The investors applies risk diversification principles based on their investment tolerance while aiming to have saved enough money pegged toward certain periods in the future known as a “time horizon”. Percent amount of capital preserved relative to capital intended for growth without sacrificing total return are some methods used by one wishing to promote appropriate retirement planning objectives.

Strategies for building a retirement fund

Retirement planning is an investment goals that focuses on creating a fund to support an individual’s lifestyle post retirement. One of the most popular options for saving towards retirement are employer-sponsored savings accounts such as 401(k) or IRA accounts.

Individuals can also deduct any contributions they make into these accounts and benefit from tax deductions.

Other strategies for building up a retirement fund include setting aside savings monthly, investing in assets like stocks or bonds, utilizing annuities and long-term investments depending on one’s age bracket. Additionally, learning new skills to increase income during post-retirement periods is also a great strategy to build your nest egg faster.

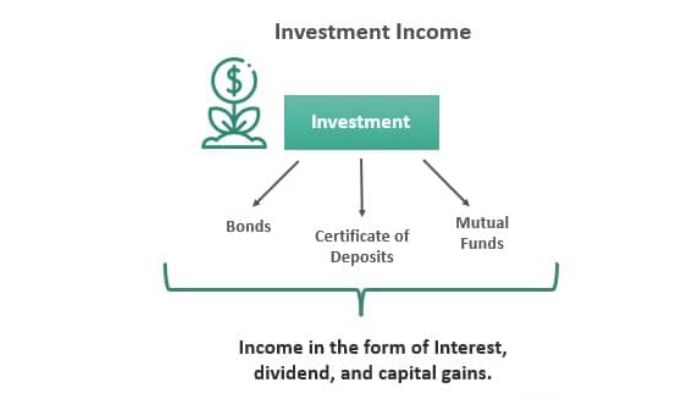

4. Income Generation

Income generation is an investment objective that focuses on creating sustainable income flows for either immediate or future use. Investors look for assets like dividend stocks, bonds, and real estate to generate a steady stream of dividends, coupon payments, or rental incomes.

Dividend stocks are a great way to receive reliable regular payouts from some of the biggest companies in the world paying out cash each quarter.

Bond investments come with periodic coupon payments until maturity, while renting your space can offer monthly added income with surprise upside during periods of high demand such as travel peaks during summer months.

Income-producing assets

Income generation is an important investing goal for many. This involves selecting assets that can provide a steady stream of income such as dividend stocks, bonds, and real estate.

Dividend stocks are shares of publicly traded companies that regularly pay out a portion of their earnings to shareholders in the form of dividends.

Bonds are debt obligations issued by corporations or governmental entities that produce regular interest payments while also yielding you principal upon maturity.

Real estate investments may include owning and leasing residential or commercial properties to earn rental income over time along with possible capital gains when sold.

These strategies work best if paired with sound long-term portfolio diversification principles, which can help protect profits and limit risk exposure while creating passive income opportunities at the same time.

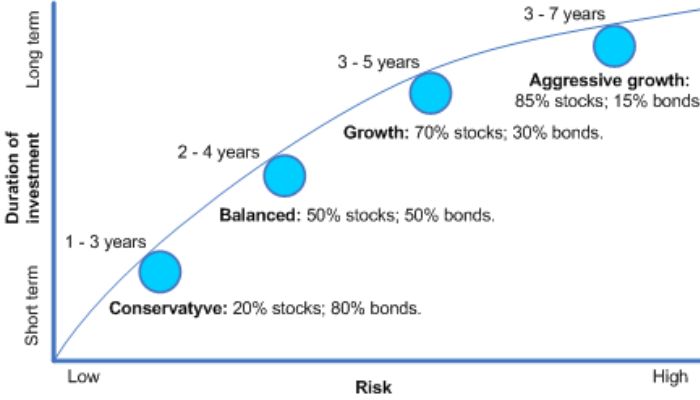

5. Risk Tolerance and Time Horizon

Risk tolerance and time horizon are important factors to consider when setting investment objectives. Risk tolerance is an investor’s willingness or ability to lose funds, while time horizon illustrates how you will achieve your financial goals over a period of time.

For example, if an individual has low risk tolerance they should stick with conservative investments such as treasuries and CDs. On the other hand, high-risk investors may be keener to aggressive stock options to generate higher returns in the short-term.

Investors with long-term outlooks have the advantage of delaying any immediate outcome which can decrease their total risks and maximize their potential rewards. All these pieces can help create portfolios tailored to your personal desires including societal values, levels of uncertainty, and liquidity needs.

Tips on aligning investment objectives with individual risk profiles

It is important for investors to consider their risk profile and time horizon when setting an investment goal. Risk tolerance refers to the amount of market volatility one can stomach in pursuit of a desired rate of return while time horizon relates to how long you plan on staying invested before needing access to your funds.

A higher risk tolerance coupled with a longer time horizon means that more risky investments such as start-ups, penny stocks, or venture capital may be appropriate assets to include in an investor’s portfolio.

On the other hand, short duration and low fatigue with loss intensity suggest lower-end risks such as treasury bonds or certificates of deposit (CDs). For most conservative investors, however, a good blend of debt and equity could options is likely preferred performance-wise over very low-risk options.

Ultimately an investor must decide which portfolio aligns best with their available resources, comfort level, and timeframe for investing – all of which have a bearing on establishing an ideal risk-reward proportion for the set investment objectives.

Conclusion

In conclusion, the top five investment objectives are capital preservation, wealth accumulation, retirement planning, income generation, and risk tolerance and time horizon. Each of these objectives involves its own set of strategies and considerations that need to be taken into account when developing a plan for reaching your financial goals.

No matter what your objective is investing should be constructed with an eye towards overall portfolio balance in terms of both expected rate of return and risk mitigation.

Additionally, it is always important to seek professional guidance when considering investments since every individual’s financial situation has unique complexities that may influence better outcomes through appropriate selection or strategy.

By taking the time to identify your personal investment goals you can achieve greater success in achieving meaningful objectives over long-term horizons while mitigating potential risks.